Urban Lifestyle Hotels & Properties

Received Learning Department Award in Student Business Project for conducting the most rigorous research

Out of 50 teams in the student business project competition held by Ecole hoteliere de Lausanne (EHL), only four team were nominated for learning department award. Our team received the 1st place in that category.

The project was evaluated by 6 professors from different areas of hospitality and industry advisor outside of school.

OVERVIEW

Urban Lifestyle Hotels & Properties (ULS) is a hotel development and ownership platform who is looking to enter the EMEA market, focusing on key gateway cities. Their first property acquisition is in Marrakech, Morocco. To challenge and assess ULS’s existing concept, our group is tasked with the market study, conceptualization and distribution strategy for entering the hospitality industry. The purpose of this project is to create a global ULS concept handbook or a tailored concept handbook to Marrakech

Where

Student Business Project @ EHL

When

April 2016- June 2016

Client

Urban Lifestyle Hotels & Properties

Keyword

Business Strategy, Hospitality, Boutique and Lifestyle

Team

Signe BernHard-Larson, Vilgot Hasse, Andrea Lindgren, Laura Nussbaumer, Iria Schwegler, Tsung-Yi Wu (me)

Research Method

Desk Research, Competitive Analysis, Semi-structured Interview, Observation

PROCESS

UNDERSTAND the MARKET

Desk Research

Goals

- Identify the impact of PESTEL factor on the local hotel market.

- Understand the current concepts and brands of boutique lifestyle products on the market

- Examine the underlying dynamics of the tourism market In Marrakesh, which lays the foundation for any hotel.

Findings

- Berlin remains to be one of the most stable markets in Europe

- Boutique hotels are about offering unique experiences to the guests, where the local surrounding plays an important role.

- Marrakech has has a strong tourism offering. However the city is always in competition with neighbouring cities

User Interview

Goals

- Understand the qualitative positioning and differentiating factors of key competitive properties.

- Analyze the micro environment by looking at the main competitors in Marrakech

Findings

- The market is predominantly dominated by small independent hotels, which has created a shortage of big branded upscale and luxury hotels

- Looking at the final competitive index, the Riad Dar One has emerged as the strongest competitor with a competitive index at 11.39 and the only player in the ‘strong’ cluster.

Onsite Inspection

Goals

- Explore the current local design and service quality of similar properties

- Identity current facilities offering and standardized operation procedure in the Marrakesh market

Findings

- The Riad market is highly competitive, and the micro location plays an important part in the positioning of each property.

- Riad 72 ranks as the most attractive property in the ranking, followed closely by Riad Idra and Riad Dar One.

CREATE the BRAND

Brand Triangle

The ULS Collection is not merely an exploration but an immersive experience, where guests’ dreams and local rituals come together to create unforgettable memories. If you enjoy life and what it has to offer, then The ULS Collection is the place for you. Its themed hotels stage the local atmosphere, invigorating all five senses and fostering the perfect environment to nurture the ULS community.

Immersive experience

Surprising and extraordinary; we touch on all

Hedonic travelers

They love life – and we love them.

Eclectic design

It’s weird, it’s fun and it makes you think twice.

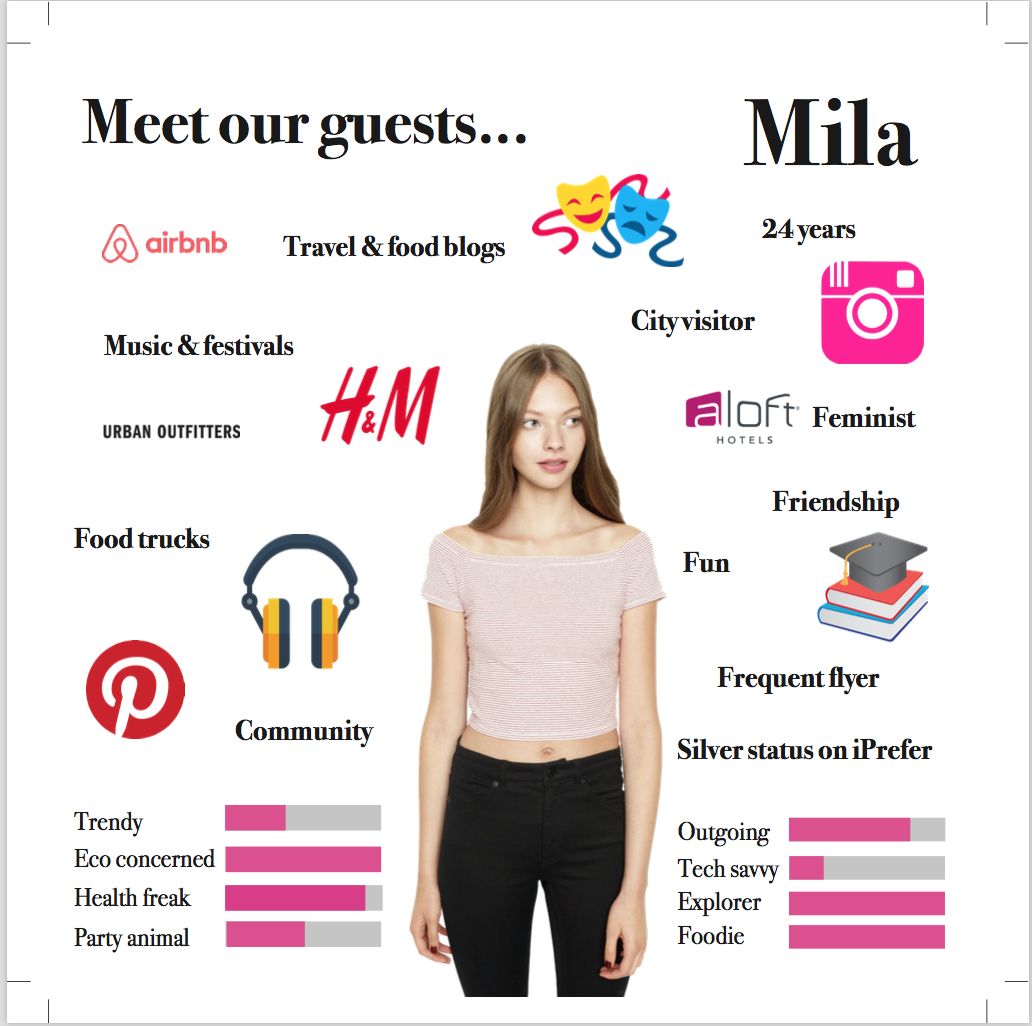

Customer Persona

User Journey

BUILD an ACTIONABLE PLAN

European Brand Strategy

Looking at the positioning matrix, the 12 brands have been mapped out according to their similarity index with The ULS Collection as well as their price level.

The ULS brand has been placed in the price cluster of €100 - €200, this will depend on locations in Europe as it varies from city to city. However, the range covers the kind of ULS products that could be on the market.

Looking at the similarity and the price, we can see that Ace Hotels falls within the price cluster of The ULS Collection, as well as being ranked as brand with the highest similarity index. The main reason for this is the concept of the brand, which focuses mainly on building communal leisure/work areas where guests can interact and socialize.

European Booking Strategy

Overall Booking

Short term

Initially when The ULS Collection starts to develop their European hotels, they will heavily invest in indirect bookings to aggressively compete with the existing players in the market such as Starwood’s W Hotels. 40% of their traffic will flow through intermediaries to gain visibility amongst new customers. On the other hand, investment in direct bookings will be minimal since the customers have not been yet been exposed to the brand. The ULS Collection’s corporate website must be fully functional before the brand is launched.

Long term

In coming years, The ULS Collection will shift its investment to direct bookings as more guests will be familiar with the brand with the help of search engine optimization and meta tags. At the same time, since indirect booking channels like Expedia continue to grow, The ULS Collection will have to continue working with their services. The chain will adjust their strategy based on the penetration of each segment and be prepared to invest in other new upcoming technologies to maintain a high direct revenue ratio.

Indirect Booking

Short term

The ULS Collection will use OTAs as their main source of indirect bookings to generate most of its hotel revenue. Six OTAs are suggested to reach all target segments.

Booking.com: Biggest OTA in the world, but it has the highest commission fees.

Expedia, Priceline, Hotels.com: Very popular OTAs in Europe with slightly lower commission fees.

- Ctrip: Biggest OTA in China with low commission fees.

- Airbnb: Popular disruptive booking platform that initially offers vocational rental.

Long term

As time progresses, The ULS Collection will put less emphasize on the top four OTAs as the brand builds its own returning customer base. The rise of Chinese travelers pushes The ULS Collection to place more resources on Ctrip to capture the growing market. Low commission fees and popular use of Airbnb will force the chains to pay attention to the Airbnb strategy and growth.

Intermediary Booking

Short term

As The ULS Collection still needs to build its global brand awareness, 60% of its total intermediary booking expenditure will be invested in Google.com (Search Engine Optimization), Google ads and Tripadvisor to be ranked high on their listing. The hotel should appear at least in the first two pages of the meta-search engines. 30% of the expenditure will be given to Kayak and Trivago to accommodate other types of potential hotel guests. The remaining 10% of the budget will be allocated to popular social media pages such as Facebook ads and WeChat.

Long term

In the long term, 10% of the initial budget allocated to Google will be equally allocated between Trivago and Kayak. Those two meta-searches need to be increased as millennials highly value convenience, which Kayak and Trivago offer as they have consolidated all the information available online in one place.

Direct Booking

Short term

The ULS Collection’s website will be the main source of direct bookings. Consequently, 40% of the direct booking budget will be assigned to develop and maintain the booking engine and optimize the website. 40% will be allocated to the application maintenance and another 10% to email marketing. The remaining 10% of the budget is used for phone calls and sales development.

Long term

With the change of customer behavior from desktop to mobile, The ULS Collection will shift more resources from the hotel’s website to iOS and Android applications. Research has proven phone and email communications to be outdated. As a result, The ULS Collection will decrease its investment to 5% in that respect.

Marketing Strategy

The ULS Collection will use a mix of offline and online marketing strategies and tools. The offline marketing strategy includes how the individual properties will use and decorate the building, how the staff will represent the brand, its different marketing material, hotel’s merchandise and how they will host different events. Additionally, they will have different PR promotions, seek relevant awards and have different partnerships with local suppliers. The ULS Collection’s online strategy follows the customer journey of how they are able to reach and find the brand, act by going on the website, converting by booking and finally how the customer engages with the brand. This will be carried out through methods such as optimizing their internet presence, using social media and content optimization. The ULS Collection will implement a CRM system called Salesforce to engage with their guests. Additionally, they will have a loyalty program and an app to interact with the guests at all times.

European Pricing Strategy

Short term

During The ULS Collection’s initial stage, the Surround pricing strategy will be used. The price of their most basic room type will be the lowest room rate amongst competitors and the price of their superior room types will be close to the competitors’ most basic room rates. This allows the brand to capture the middle market, as well as the lower and higher markets. The Surround strategy will create the awareness needed in order to grow market share. The prices will range from €100 to €160. However, this strategy is only short term in order to create awareness. The risk of continuing with the Surround strategy is that guests may start thinking that the brand is of low value and profit margins will drop over time.

Long term

Based on the distribution analysis, hotels perform the strongest when they price their rooms higher than the competition and maintain a consistent relative price over time. Therefore, when The ULS Collection reaches 50+ keys, the Match strategy will be applied. To match, the chain will set one room rate comparable to the competitors and the other room rates slightly higher. The rates will range from €140 to €200 depending on market. This allows the chain to stay competitive for a larger pool of customers, yet does not undercut the competition.

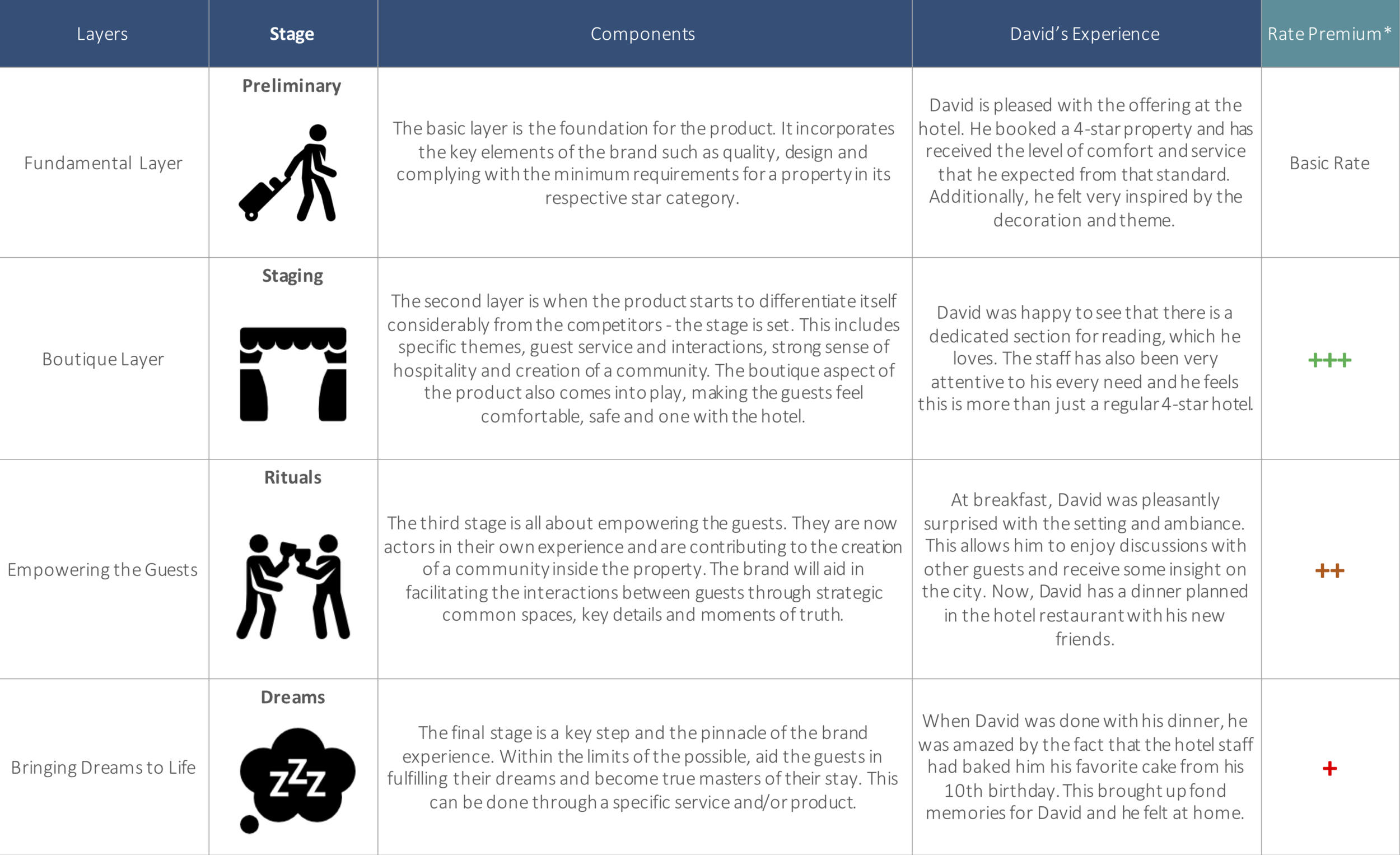

Value Proposition

Marrakesh Strategy

FUTURE WORK

Data Collection: Although we did not learn this in school, but if we had knowledge of data crawling, we could've gathered more booking prices to more accurately analysis the seasonality of hotel's in Marrakesh.

Other Prototype: For hotelier, room is the key to revenue. Though out of our scope, we could've designed interactive prototypes to present our strategy to our client